Trace’s carbon accounting (aka carbon emissions calculation) methodology aligns to the standards outlined by the Greenhouse Gas Protocol (otherwise known as the ‘GHG Protocol’, ‘The Protocol’ or ‘GHGP’ for short).

The GHG Protocol is the leading international guideline for carbon accounting and forms the foundation for Trace’s methodology. The GHGP defines the scope of activities that must be included in a company’s carbon footprint and creates a standardised emissions measurement methodology. The GHGP guidelines were developed by the World Resources Institute (WRI) and World Business Council for Sustainable Development (WBCSD) in collaboration with governments, industry associations, NGOs, and corporations.

Trace applies the standards from the following documents

The Corporate Standard is considered the “gold standard” for corporate emissions measurement around the world. The Protocol is the foundation for most global climate reporting standards, including the Taskforce for Climate-related Financial Disclosures (TCFD), which has been adopted by the International Sustainability Standards Board (ISSB), and the Science Based Targets Initiative.

“GHG emissions should be calculated in line with the GHG Protocol methodology to allow for aggregation and comparability across organizations and jurisdictions.” - TCFD

“Companies must follow the GHG Protocol Corporate Standard, Scope 2 Guidance, and Corporate Value Chain (Scope 3) Accounting and Reporting Standard.” - SBTi

The Protocol covers the following, which are summarised below according to Trace’s adoption:

Boundary setting is an important process which defines the scope of activities included in and excluded from your Organisation's emissions inventory and whether they are Scope 1, 2 or 3 emissions.

For example, if a company owns or leases a fleet of vehicles, any fuel related emissions are Scope 1. If the company hires vehicles via a third party, the emissions are considered Scope 3.

To facilitate accurate reporting on your emissions via TCFD, ISSB, GRI and CDP, and other disclosure frameworks, Trace will help you define your organisational and operational boundaries.

The organisational boundary determines which entities (e.g., subsidiaries, joint ventures, partnerships) and assets (e.g., facilities, vehicles) will be included in the GHG emissions inventory. The GHG Protocol offers 3 approaches to Organisational Boundary setting - see Table 2.

Trace utilises the operational control approach which means an organisation accounts for 100% of the GHG emissions over which it and its subsidiaries have operational control. It does not account for GHG emissions from operations it owns equity in but does not have operational control over. For example, if the organisation is the operator of a facility, it will have the full authority to introduce and implement its operating policies and thus has operational control.

Table 1

This table shows several types of entities and assets and how they are included in the scope 1 and scope 2 inventory under the three different approaches.

The Operational Boundary defines the specific activities and processes over which your Organisation has operational control and therefore must be included in the emissions inventory or justification for exclusion must be disclosed.

We make it easy for our clients by providing a recommended emissions boundary based on industry type and the typical level of control that similar organisations have over their Scope 3 emissions sources.

Following the GHG Protocol, all Scope 1 and 2 emissions and relevant Scope 3 emissions must be included in the inventory. Scope 3 emission sources are deemed relevant if at least two of the following criteria are met:

Trace excludes all Downstream activities (categories 9-15) by default due to the complexity and reliance on high level assumptions required to calculate the emissions associated with these activities. If an organisation requires a complete lifecycle analysis of their products including these activities, Trace offers bespoke advisory solutions or can recommend partner firms to carry out this analysis.

Diagram 1: GHG Protocol emissions diagram

Trace’s emissions engine covers:

The GHG Protocol defines different formulae to calculate the emissions in each emissions category, according to the input data available. The formula is simple:

Trace’s carbon calculation engine applies the recommended formula according to the data provided by the reporting company - generally a combination of spend and activity data.

For Scope 3 emissions, we adopt a hybrid approach to carbon accounting that allows our customers to input spend and activity data according to what data sources are available across their value chain.

Each data point corresponds with an emissions factor depending on the unit of data provided:

This multiplication process is repeated for all goods, services, and activities within an organisations’ operations and value chain. The sum of all of these values represents your total carbon footprint.

Using a hybrid approach to carbon accounting allows Trace to produce an accurate and comprehensive carbon inventory by combining the strengths of spend-based and activity-based analysis. Using a hybrid approach also allows us to leverage the most suitable data sources in different areas of your operations, better accommodating unique circumstances to allow for a more reliable carbon footprint calculation.

Trace’s use of a hybrid approach enhances the reliability of your carbon measurement and empowers you to make highly informed sustainability decisions that are aligned with international standards of reporting and action.

Our model has been independently reviewed and verified by environmental consultancy, Energy Link Services and we continuously review and enhance the underlying data to ensure accuracy, transparency and recency.

The GHG Protocol defines 2 methods for Scope 2 calculation

Trace uses the location-based approach, unless specifically directed by the customer. This means we consider ‘carbon neutral’ electricity as zero emissions and use the location-specific emissions factor for any non-carbon neutral grid electricity. We define ‘carbon neutral’ electricity as ‘Green Power’, certified carbon neutral energy plans from retailers, PPAs, LGCs and ‘behind the meter’ renewable energy generated on site (e.g. solar panels).

Additional notes

While the GHG Protocol defines how emissions factors should be used in carbon accounting, it does not prescribe which emissions factor sources should be used.

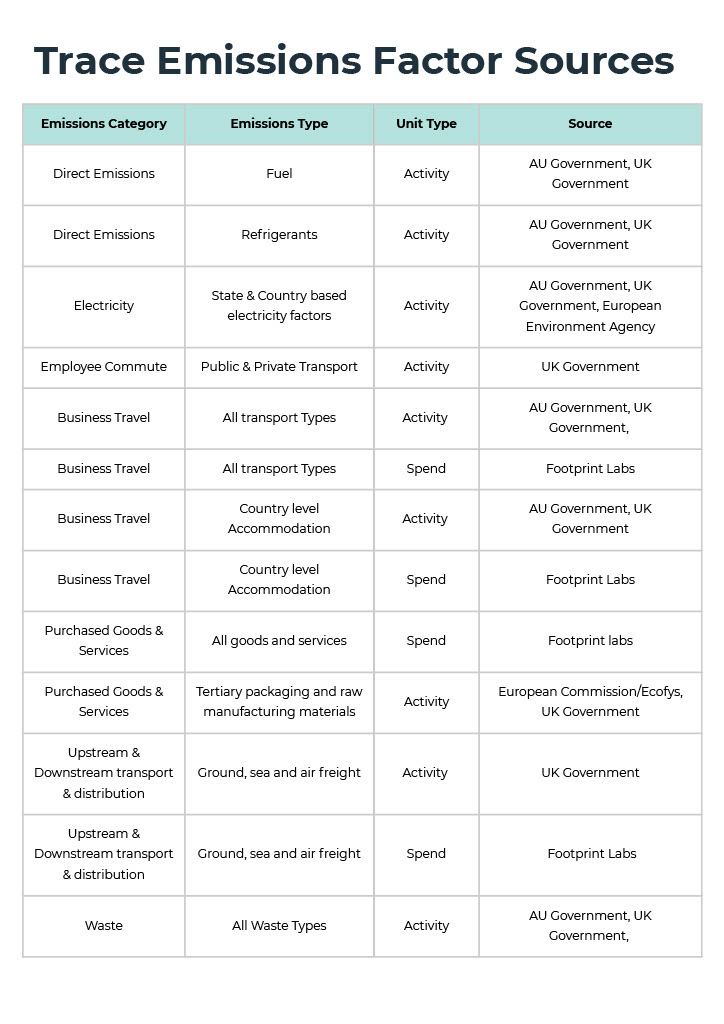

Trace has developed a proprietary database of over 4,500 individual emissions factors from a variety of public and private sources. Each individual source has undergone a rigorous due diligence process (see below). A table of our key sources by emissions category has been provided in Table 2. These key sources are applied according to your business’ activities and data availability.

Table 2 - Trace Emissions Factor sources

Trace is rigorous in the selection of emissions factors we use in order to cover the breadth and depth of our clients’ industries. Since transparency is a core principle of carbon accounting, it is important to us that we are able to verify the credibility of each source, as defined by the following criteria:

Using all of the above criteria, we review each potential source’s credibility before using them to calculate emissions.

Trace updates its emissions factors in accordance with updates made to the source data, as such our database is NOT updated on a consistent timeline but rather at a bespoke pace. Our in-house sustainability experts closely monitor updates from the publishers to ensure we update relevant emissions factors as soon as possible once they have been updated and verified. We also perform an annual audit of the database to ensure that the sources we are using are the best available emissions factors in terms of accuracy, recency and relevancy.

Emissions factors within our database include an audit trail of updates and the sources used so that they can be audited externally. The emissions factors used in your company’s carbon assessment are auditable on request.

Trace does not define the exact 12 month period of data required for the CO2 assessment but recommends submitting data that is as recent as possible, so that the CO2 assessment represents a realistic picture of the businesses’ current emissions profile.

The data must represent a 12 month period that has an end date no more than 6 months prior to the date of data submission. In order to achieve ‘Carbon Neutral / Positive’ Certification, offsetting must occur within 9 months of the end of the measurement period, otherwise a reassessment will be required at additional cost to the customer.